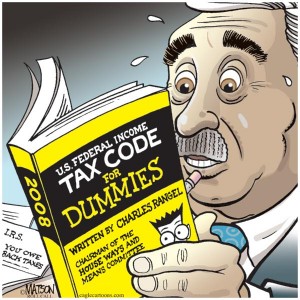

How Much do You Pay in Taxes?

If, from the more wretched parts of the old world, we look at those which are in an advanced stage of improvement, we still find the greedy hand of government thrusting itself into every corner and crevice of industry, and grasping the spoil of the multitude. Invention is continually exercised, to furnish new pretenses for revenues and taxation. It watches prosperity as its prey and permits none to escape without tribute. —Thomas Paine, Rights of Man

President Obama has made taxes a campaign issue. Ronald Reagan once famously said, “If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.†A truer statement has never been made. Governments tax everything. Most people have no idea how much they are taxed.

I was camping once with a progressive who said taxes should be raised on people like himself who made a comfortable living. We were sitting around a campfire and as I threw another log on the fire, I asked how much he thought he ought to be taxed and he said he didn’t think forty percent was unreasonable. I laughed. He asked what was so funny. I told him we both made low six figure incomes and I knew he was already paying over fifty percent of his income in taxes. He adamantly denied it.

I said let’s start with payroll tax. We’re both self-employed so we have to pay both sides of Social Security and Medicare. He said he wasn’t counting that, but admitted it was a painful 15.3%. We reduced it to 9.8% because his income exceeded the Social Security cut-off (Medicare has no cut-off).

I said let’s start with payroll tax. We’re both self-employed so we have to pay both sides of Social Security and Medicare. He said he wasn’t counting that, but admitted it was a painful 15.3%. We reduced it to 9.8% because his income exceeded the Social Security cut-off (Medicare has no cut-off).

Then I guessed his effective federal income tax rate had to be at least 25%, but he claimed it was only 21% of his gross income. Fine, that was still 30.8%.

And his California income tax? At first, he first said he wasn’t counting that, but admitted it was around 5%. Again, I thought he was purposely underestimating, but I accepted his number for a total of 35.8%.

Next I asked how much he spent on sales taxable items per year. Again, he said he wasn’t counting that. California sales tax was 8.75%, so after some haggling we settled on an estimate of about 1.5% of his gross income by averaging his vehicle purchases over three years. We were at 37.3%

How about his property tax, I asked. Again, he said he wasn’t counting that. Eventually, he admitted it was close to 4% of his gross income. We were up to 41.3%.

I pointed at his fifth-wheel and extended-cab truck. (We weren’t exactly roughing it.) How much in personal property tax for that rig and your other car? He said he wasn’t counting that, but admitted it was at least another 1% of his gross income. Now we were at 42.3%

Doesn’t that thing use a lot of gasoline? His expression told me he had already figured out where I was going with that one, but was still surprised to discover that California had the highest fuel tax in the nation at 46.6 cents per gallon. After some rough guesswork, we came up with about another .3% for fuel tax. Now we had a figure of 42.6%.

He looked smug and said that was less than 50%. I agreed. Then I told him he was still forgetting some things. I rattled off the following list.

Everything he spent, including his mortgage and vehicle loans, included a hidden 35% corporate tax—all buried in the price of goods and services.

He loved Irish whiskey, but had no idea there was a $16.80 combined state and federal tax per gallon.

I told him he was lucky he didn’t smoke because there was nearly $2.00 federal and state tax per pack.

Pistols also have a special 10% tax on the purchase price.

The price of many foreign-made goods included a hidden excise tax.

Every utility bill like gas electric, phone, and cable had special taxes to finance discounted or free rates for the indigent.

Since we both made our living by billing by the hour, I asked him how many earning hours he lost every year for tax preparation and record keeping. (He refused to theoretically charge the government the same rate as clients.)

Despite denying a tax deduction for Social Security and Medicare payments, it was likely they would tax the benefits after he retired.

There are numerous taxes hidden in ObamaCare, one of which is a 3.8% tax on all real estate transactions.

Finally, if during his lifetime he were able to save a reasonable nest egg, government would claim a piece of it after he died.

By this time our campfire had died down. My friend stood up and said he was going to bed. For the next three days he moped around. Finally, he took me aside to tell me he was already taxed enough, but still supported taxing the rich. They had plenty and could afford to pay more. I took a long look at his expensive rig before saying, that’s fine, but remember 95% of Americans are looking at you as the rich guy who can afford to pay more.

He stomped off without another word.

James D. Best is the author of the Steve Dancy Tales and Tempest at Dawn, a novel about the 1787 Constitutional Convention. Look for his new book, Principled Action, Lessons from the Origins of the American Republic.

The posts are coming!

The posts are coming!

1 comment

It’s just too bad the fact will have no effect on his thinking.

[Reply]

Leave a Comment